real estate investment cash flow projection

Ever wonder if that charming fixer-upper is actually a money pit in disguise? Real estate investing can be incredibly rewarding, but it's also fraught with risks. The key to navigating this complex landscape is understanding the numbers before you even think about signing on the dotted line. That's where cash flow projection comes in!

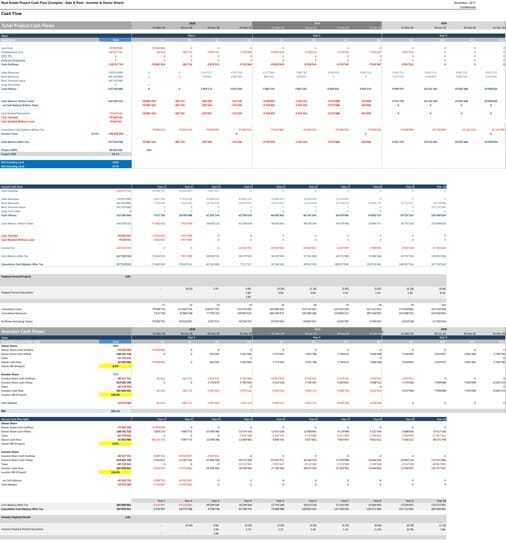

Many investors find themselves overwhelmed by spreadsheets, uncertain assumptions about future rental rates, and the daunting task of anticipating every possible expense. Without a clear picture of potential cash flow, it's easy to make decisions based on gut feeling rather than sound financial analysis, which can lead to unexpected financial strain and missed opportunities.

The goal of real estate investment cash flow projection is to provide you with a realistic estimate of the income you can expect to generate from a property over a specific period. It allows you to assess the viability of an investment, compare different opportunities, and make informed decisions about your portfolio.

This article delves into the world of real estate investment cash flow projection. We'll explore its purpose, benefits, essential components, common challenges, and best practices. By mastering this crucial skill, you'll be well-equipped to make informed investment decisions, maximize your returns, and build a thriving real estate portfolio. Keywords include: Real Estate, Investment, Cash Flow, Projection, Rental Income, Expenses, Vacancy Rate, Financial Analysis.

The Purpose of Real Estate Investment Cash Flow Projection

The main objective of real estate investment cash flow projection is to forecast the net income that a property is expected to generate after accounting for all income and expenses. It provides a financial roadmap that helps investors understand the potential profitability of a real estate venture. I remember when I first started investing, I completely overlooked the importance of factoring in things like property management fees and potential repair costs. I was so focused on the potential rental income that I failed to account for the inevitable expenses that come with owning property. This resulted in a much smaller cash flow than I had anticipated, and it taught me a valuable lesson about the importance of thorough cash flow projections. A well-structured projection factors in potential rental income, vacancy rates, property taxes, insurance costs, maintenance expenses, and financing costs (like mortgage payments). By considering all these elements, investors can get a much more accurate picture of the true cash flow potential of a property. Furthermore, it allows you to compare different investment properties based on their projected cash flow, helping you to choose the most profitable option. Cash flow projection is a cornerstone of successful real estate investing, enabling investors to make informed decisions, manage risk, and achieve their financial goals.

What is Real Estate Investment Cash Flow Projection?

Real estate investment cash flow projection is a process of estimating the future income and expenses associated with a rental property to determine the net cash flow it is likely to generate. It's essentially a financial forecast that helps investors assess the profitability and viability of an investment. Unlike a simple profit calculation that might only consider income and a few obvious expenses, a cash flow projection aims for a more comprehensive view. It takes into account all potential sources of income, such as rental income, application fees, late fees, and any other revenue streams. On the expense side, it includes everything from mortgage payments and property taxes to insurance, maintenance, repairs, property management fees, and even potential vacancy periods. The resulting figure, the net cash flow, represents the actual cash an investor can expect to pocket after all expenses are paid. This figure is crucial for evaluating the return on investment (ROI), determining whether a property can cover its own expenses, and making informed decisions about purchasing, holding, or selling a property. A solid cash flow projection provides a realistic snapshot of a property's financial performance and allows investors to plan their finances accordingly.

History and Myth of Real Estate Investment Cash Flow Projection

While the formal concept of real estate investment cash flow projection as we know it today has evolved alongside modern financial analysis, its roots trace back to the earliest days of real estate investment. Landlords and property owners have always intuitively assessed the potential income from their properties against anticipated expenses. However, before the advent of spreadsheets and sophisticated financial tools, these projections were often based on simpler calculations and rules of thumb. The rise of professional real estate investment and the increasing complexity of financing structures fueled the development of more rigorous and detailed cash flow projection methods. One common myth is that a high gross rental income automatically translates to positive cash flow. While strong rental income is certainly desirable, it's the net cash flow that truly matters. Another myth is that accurate cash flow projections are impossible due to the inherent uncertainties of the real estate market. While it's true that market conditions can change unexpectedly, a well-structured projection incorporates conservative assumptions and contingency plans to mitigate the impact of unforeseen events. The most dangerous myth is believing "it always goes up!". Real Estate market, like any market, can go up, down, or remain stable. This makes real estate investment cash flow projection very important to evaluate worst case senario, to avoid the trap of "it always goes up!"

Hidden Secrets of Real Estate Investment Cash Flow Projection

One often overlooked aspect of real estate investment cash flow projection is the impact of taxes. While calculating net operating income (NOI) is important, it's crucial to also factor in potential tax liabilities. Depreciation, for example, can significantly reduce your taxable income, while capital gains taxes can impact your profits upon selling a property. Another secret lies in understanding the local market dynamics. A seemingly minor detail, such as a planned infrastructure project or a change in zoning regulations, can have a major impact on rental demand and property values. It's essential to stay informed about local developments and incorporate them into your projections. Furthermore, don't underestimate the power of networking. Connecting with other investors, property managers, and real estate professionals can provide valuable insights and access to information that isn't readily available elsewhere. Learning from the experiences of others can help you refine your projection assumptions and avoid costly mistakes. A really hidden one is the cost of your time, which is sometime ignored by investors. They spend hours on the properties but never take into consideration the price for the time they have spent.

Recommendations for Real Estate Investment Cash Flow Projection

When it comes to real estate investment cash flow projection, my top recommendation is to be conservative with your assumptions. It's always better to overestimate expenses and underestimate income than the other way around. This will give you a more realistic picture of the potential downside risks and help you avoid unpleasant surprises down the road. Another key recommendation is to use reliable data sources. Don't rely solely on anecdotal evidence or gut feelings. Instead, gather information from reputable sources like local market reports, property management companies, and real estate data providers. These sources can provide valuable insights into rental rates, vacancy rates, and expense trends. Additionally, I highly recommend using a spreadsheet program or real estate investment software to create your projections. These tools can automate calculations, track expenses, and generate reports, making the process much more efficient and accurate. Finally, don't be afraid to seek professional help. Consulting with a financial advisor, accountant, or real estate attorney can provide valuable guidance and ensure that your projections are accurate and compliant with all applicable laws and regulations. Always remember that you should calculate a few times, and not only once. This way you can see different senarios.

Delving Deeper: Key Components of a Cash Flow Projection

A robust cash flow projection comprises several essential components. First, you need to estimate the potential rental income based on comparable properties in the area. Research current rental rates for similar units, taking into account factors like size, location, and amenities. Next, factor in a realistic vacancy rate, which is the percentage of time the property is likely to be vacant. This rate will vary depending on the location and the overall rental market. You'll also need to estimate all operating expenses, including property taxes, insurance, maintenance, repairs, property management fees, and utilities (if included in the rent). Don't forget to include any miscellaneous expenses, such as advertising costs or landscaping fees. Finally, factor in any debt service, such as mortgage payments or loan interest. Once you have all these components in place, you can calculate the net operating income (NOI) by subtracting operating expenses from gross rental income. Then, subtract debt service from NOI to arrive at the net cash flow. Remember to consider all these variables, and do not miss any one of them. This way you can see clear the overall picture.

Tips for Accurate Real Estate Investment Cash Flow Projection

Achieving accuracy in real estate investment cash flow projection requires a disciplined approach and attention to detail. One crucial tip is to conduct thorough due diligence on the property and the surrounding market. This includes inspecting the property for any potential repair needs, researching local rental rates and vacancy rates, and understanding the demographics and economic trends of the area. Another helpful tip is to use a consistent methodology for creating your projections. Develop a standardized template or spreadsheet that includes all the necessary components and ensures that you are using the same formulas and assumptions for each property. This will make it easier to compare different investment opportunities and track your portfolio's performance over time. It's also important to regularly update your projections as new information becomes available. Market conditions can change rapidly, so it's essential to monitor rental rates, vacancy rates, and expense trends on an ongoing basis. Be prepared to adjust your projections accordingly to reflect any changes in the market. The number one tip is "be honest with yourself" and keep up to date information.

Avoiding Common Pitfalls in Cash Flow Projections

Even with the best intentions, it's easy to fall into common traps when creating cash flow projections. One frequent mistake is being overly optimistic about rental income and underestimating expenses. It's tempting to assume that you'll be able to charge top dollar for rent and that expenses will remain low, but it's important to be realistic and factor in potential vacancy periods and unexpected repairs. Another common pitfall is neglecting to account for capital expenditures, such as roof replacements or appliance upgrades. These expenses can significantly impact your cash flow and should be included in your projections, even if they are not expected to occur in the near term. It's also important to avoid relying on outdated or inaccurate data. Make sure you are using current market data from reliable sources and that your assumptions are based on sound reasoning. And one last common mistake is ignoring your local market analysis. It is very important and must be done.

Fun Facts About Real Estate Investment Cash Flow Projection

Did you know that professional real estate investors often use multiple cash flow scenarios in their analysis? Instead of relying on a single projection, they create best-case, worst-case, and most-likely-case scenarios to assess the potential range of outcomes. This helps them to better understand the risks and rewards associated with an investment. Another fun fact is that cash flow projections can be used to negotiate better terms with lenders. By demonstrating a property's strong cash flow potential, you may be able to secure a lower interest rate or more favorable loan terms. Also, cash flow projection can also save your day. Cash Flow projection always helps you be aware of the cost and money you have, so you can avoid being late with payments, which saves you from penalties. So if you are a person with great financial habits, it is very likely your cash flow projection is going to be very close to what you have projected. Keep up the good work.

How to do Real Estate Investment Cash Flow Projection

Creating a real estate investment cash flow projection involves a series of steps. First, gather information about the property, including its purchase price, mortgage terms, potential rental income, and operating expenses. Then, create a spreadsheet or use real estate investment software to organize the data. Begin by estimating the gross rental income, taking into account the property's size, location, and amenities. Next, factor in a realistic vacancy rate based on local market conditions. Estimate all operating expenses, including property taxes, insurance, maintenance, repairs, property management fees, and utilities (if included in the rent). Calculate the net operating income (NOI) by subtracting operating expenses from gross rental income. Finally, subtract debt service (mortgage payments) from NOI to arrive at the net cash flow. Review your assumptions and update the projection regularly as new information becomes available. Keep it simple, and keep it update with new information so you always know your best and worst case senarios.

What if in Real Estate Investment Cash Flow Projection?

Scenario planning is crucial in real estate investment cash flow projection. "What if" scenarios allow you to assess the potential impact of various events on your cash flow. What if rental rates decline due to increased competition? What if vacancy rates increase due to an economic downturn? What if unexpected repairs are needed? By modeling these scenarios, you can identify potential risks and develop contingency plans to mitigate their impact. For example, you might consider setting aside a reserve fund to cover unexpected expenses or diversifying your portfolio to reduce your exposure to any one particular market. "What if" analysis also helps you to identify opportunities. What if you can increase rental income by upgrading the property? What if you can reduce expenses by implementing energy-efficient improvements? By exploring these possibilities, you can optimize your cash flow and maximize your return on investment. Also, "what if" scenerios can let you know if this real estate investment is a good deal or not.

Listicle of Real Estate Investment Cash Flow Projection

Here's a quick list of key takeaways about real estate investment cash flow projection:

- It's a financial forecast that estimates the future income and expenses of a rental property.

- It helps investors assess the profitability and viability of an investment.

- It considers all potential sources of income and expenses, including rental income, vacancy rates, property taxes, insurance, maintenance, and financing costs.

- It provides a realistic snapshot of a property's financial performance.

- It allows investors to plan their finances accordingly and make informed decisions about purchasing, holding, or selling a property.

- Conservative assumptions and reliable data sources are essential for accurate projections.

- Scenario planning ("what if" analysis) helps to identify potential risks and opportunities.

- Regular updates are necessary to reflect changing market conditions.

- Professional help can provide valuable guidance and ensure accuracy.

- Mastering cash flow projection is crucial for successful real estate investing.

Question and Answer of Real Estate Investment Cash Flow Projection

Question 1: What's the difference between gross rental income and net cash flow?

Answer: Gross rental income is the total income you collect from rent before any expenses are paid. Net cash flow is the actual cash you have left over after paying all expenses, including mortgage payments, property taxes, insurance, maintenance, and other operating costs.

Question 2: What's a good vacancy rate to assume in a cash flow projection?

Answer: The ideal vacancy rate depends on the local market. However, a conservative approach is to assume a vacancy rate of at least 5% to 10% to account for potential periods of vacancy between tenants.

Question 3: How often should I update my cash flow projections?

Answer: You should update your cash flow projections at least annually, or more frequently if there are significant changes in the market or your property's expenses.

Question 4: Is it better to overestimate expenses or underestimate income in a cash flow projection?

Answer: It's generally better to overestimate expenses and underestimate income to provide a more conservative and realistic assessment of the potential risks and rewards.

Conclusion of Real Estate Investment Cash Flow Projection

Real estate investment cash flow projection is more than just crunching numbers; it's about gaining a deep understanding of the potential financial performance of a property and making informed decisions. By accurately forecasting income and expenses, you can assess the viability of an investment, compare different opportunities, manage risk, and ultimately achieve your financial goals. Remember to be conservative with your assumptions, use reliable data sources, and regularly update your projections to reflect changing market conditions. With a solid understanding of cash flow projection, you'll be well-equipped to navigate the complexities of real estate investing and build a thriving portfolio. You need to consider it's an investment tool to improve your overall money strategy.

Post a Comment