real estate investment cash flow analysis

Imagine sinking your hard-earned savings into a real estate investment, only to find yourself constantly shelling out more than you're bringing in. The dream of passive income turns into a nightmare of endless expenses. Sound familiar? It doesn't have to be this way. Mastering the art of cash flow analysis can transform your real estate ventures from financial drains into wealth-building machines.

Many investors struggle to accurately predict the financial performance of their properties. They might underestimate expenses, overestimate rental income, or fail to account for unexpected vacancies. These miscalculations can lead to negative cash flow, eating into profits and potentially jeopardizing the entire investment. Furthermore, comparing different investment opportunities becomes a challenge without a standardized way to assess their cash-generating potential.

The purpose of real estate investment cash flow analysis is to determine whether an investment property will generate positive cash flow, which means the income from the property exceeds the expenses. It helps investors assess the profitability and financial viability of a potential investment, allowing them to make informed decisions. A thorough cash flow analysis considers all sources of income (rent, parking fees, laundry, etc.) and all expenses (mortgage payments, property taxes, insurance, maintenance, vacancy, etc.) to provide a clear picture of the property's financial performance.

This article delves into the essential aspects of real estate investment cash flow analysis, providing a comprehensive guide to understanding and utilizing this critical tool. We will explore its meaning, explore common misconceptions, reveal hidden secrets, offer practical tips, and address potential challenges. Keywords include: real estate investment, cash flow analysis, property investment, rental income, expenses, profitability, financial viability, investment decisions.

My First Real Estate Cash Flow Mishap

I remember my first real estate investment like it was yesterday. I was so excited about owning property and becoming a landlord. I did some basic calculations, looked at the rental market, and thought I had a solid deal. I focused on the purchase price and projected rental income, but I completely overlooked the finer details. I closed the deal feeling like a real estate mogul, ready to collect those sweet rental checks. The first month went smoothly. Rent came in, I paid the mortgage, and I had a small profit. I patted myself on the back, confident in my investing prowess. Then, reality hit. The second month, the water heater died. A costly repair that ate into my profits. Then came property taxes, higher than I anticipated. And then, the worst: my tenant moved out unexpectedly, leaving me with a vacant property and zero income. I hadn't factored in vacancy rates, repair costs, or accurate property tax assessments. What I thought was a profitable venture quickly turned into a money pit. My initial excitement turned into stress and regret. It was a harsh lesson, but a valuable one. I realized that a proper cash flow analysis wasn't just a suggestion, it was an absolute necessity for successful real estate investing. From that moment on, I vowed to never make the same mistake again. I learned to meticulously account for every possible expense, including those unexpected ones. I started researching vacancy rates in my area, estimating repair costs more accurately, and creating a reserve fund for emergencies. Now, before I even consider a property, I conduct a thorough cash flow analysis. I analyze potential income and expenses, considering various scenarios and market conditions. Only then do I make a decision. The experience taught me that real estate investing is not just about finding a good deal, it's about understanding the numbers and managing your cash flow effectively.

What is Real Estate Investment Cash Flow Analysis?

Real estate investment cash flow analysis is the process of evaluating the income and expenses associated with a rental property to determine its profitability. It goes beyond simply looking at the purchase price and potential rental income. It involves a comprehensive assessment of all factors that affect the property's cash flow, including mortgage payments, property taxes, insurance, maintenance, repairs, vacancy rates, and management fees. In essence, it's about understanding how much money you'll actually have in your pocket after all expenses are paid. The goal of cash flow analysis is to determine if a property will generate positive cash flow, meaning that the income exceeds the expenses. Positive cash flow indicates that the investment is financially viable and can provide a steady stream of income. Conversely, negative cash flow means that the expenses are higher than the income, requiring you to contribute additional funds to cover the shortfall. A thorough cash flow analysis can help you compare different investment opportunities and choose the properties that are most likely to generate positive returns. It also allows you to identify potential risks and challenges, such as high vacancy rates or unexpected repair costs. By understanding the numbers, you can make informed decisions and avoid costly mistakes. Cash flow analysis is an ongoing process. It's not just something you do before buying a property. It's important to regularly review your cash flow projections and adjust them as needed to reflect changing market conditions and property expenses. This will help you stay on top of your finances and ensure that your investments remain profitable.

The History and Myths of Real Estate Investment Cash Flow Analysis

While the concept of evaluating income and expenses has existed for centuries, the formal approach to real estate investment cash flow analysis is a relatively modern development. Early real estate investors often relied on intuition and general market trends to make decisions. Detailed financial analysis was less common. As the real estate market became more complex and competitive, the need for more sophisticated tools emerged. The development of financial calculators and spreadsheets made it easier to perform detailed cash flow projections. Today, specialized software and online tools are available to streamline the process. One common myth is that positive cash flow is the only factor that matters. While positive cash flow is desirable, it's important to consider other factors, such as appreciation potential and tax benefits. A property with low cash flow but high appreciation potential might still be a worthwhile investment. Another myth is that cash flow analysis is too complicated for beginners. While it can seem daunting at first, the basic principles are relatively simple. With practice and the right tools, anyone can learn to perform a basic cash flow analysis. There is also the myth that you only need to do cash flow analysisbeforeyou buy a property. This is false. You need to continuously monitor and re-evaluate your cash flow, especially as expenses fluctuate or market conditions change. Keeping your analysis updated will help you make informed decisions throughout the investment period. Cash flow analysis also helps bust the myth that all real estate investments are profitable. It provides concrete data to assess the financial viability of a property, helping you avoid investments that may look promising on the surface but could lead to financial losses. Finally, it is a myth that a high rental rate guarantees positive cash flow. Expenses like maintenance, property taxes, and vacancy can significantly impact your returns, emphasizing the importance of a comprehensive analysis beyond just income.

The Hidden Secrets of Real Estate Investment Cash Flow Analysis

One of the biggest secrets to successful real estate investment cash flow analysis is to be realistic, even pessimistic, about your assumptions. Many investors overestimate rental income and underestimate expenses, leading to inaccurate projections. A conservative approach is always best. Don't rely on rosy scenarios. Another secret is to factor in vacancy rates. Vacancy is inevitable. Even the best properties will experience periods of vacancy between tenants. Failing to account for vacancy can significantly impact your cash flow. A good rule of thumb is to estimate at least 5% vacancy, but this can vary depending on the location and type of property. Another secret is to create a reserve fund for unexpected expenses. Repairs, maintenance, and other unforeseen costs can quickly eat into your profits. Having a reserve fund can help you weather these storms without jeopardizing your financial stability. Another hidden element is to perform a sensitivity analysis. A sensitivity analysis involves testing how your cash flow projections change under different scenarios. For example, what happens if rental income decreases by 5%? What happens if property taxes increase by 10%? Sensitivity analysis can help you identify the most critical factors affecting your cash flow and prepare for potential risks. Pro Tip: Research property management fees carefully. Property management can significantly impact your cash flow. While hiring a property manager can save you time and hassle, it also comes at a cost. Get quotes from multiple property managers and compare their fees and services before making a decision. A often overlooked expense is capital expenditures (Cap Ex). These are significant expenses that improve the property but are not routine maintenance, like a new roof or HVAC system. Setting aside funds for Cap Ex is crucial for long-term financial health. And lastly, remember inflation! Costs will rise over time, so factoring in inflation can lead to a more realistic picture of future expenses.

Recommendations for Real Estate Investment Cash Flow Analysis

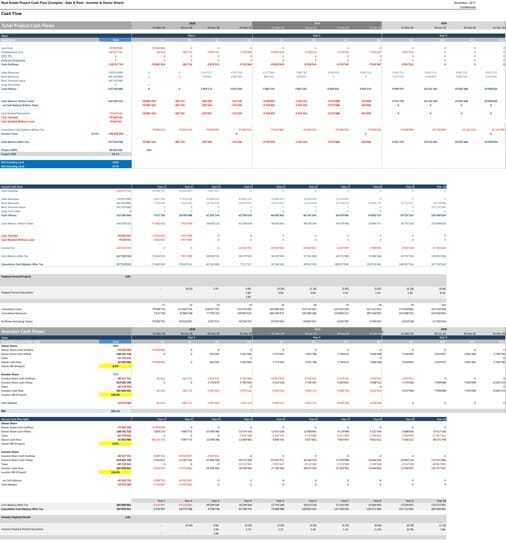

My top recommendation is to use a spreadsheet or specialized software for your cash flow analysis. While you can do the calculations manually, a spreadsheet or software program will make the process much easier and more accurate. There are many free and paid options available. Use a separate line item for each source of income and expense. This will make it easier to track your cash flow and identify potential problems. Track your actual income and expenses on a regular basis and compare them to your projections. This will help you identify any discrepancies and make adjustments as needed. Regularly review your cash flow projections and update them as needed to reflect changing market conditions and property expenses. This is especially important if you experience unexpected vacancies, repairs, or other changes. Seek professional advice from a real estate accountant or financial advisor. They can provide valuable insights and guidance. Learn from the mistakes of others. Read books, articles, and blog posts about real estate investing and cash flow analysis. Attend seminars and workshops. Network with other investors. Don't be afraid to ask questions. Never overestimate income. Be realistic, and even a bit pessimistic, about what you can charge for rent. It's better to be surprised by higher income than devastated by a shortfall. Get pre-approved for financing. This will give you a clear understanding of how much you can borrow and what your mortgage payments will be. Factor in closing costs. These can add up quickly, so be sure to include them in your cash flow analysis. Understand your local market. Research vacancy rates, rental rates, and property values in your area. Be prepared to walk away from a deal if the numbers don't make sense. Don't let emotions cloud your judgment. Treat real estate investing like a business. Make decisions based on data and analysis, not on gut feelings.

Calculating Key Metrics

Understanding and calculating certain key metrics is crucial for effective real estate investment cash flow analysis. One of the most fundamental metrics is Net Operating Income (NOI). NOI is calculated by subtracting operating expenses from gross income. Operating expenses include property taxes, insurance, maintenance, property management fees, and other expenses necessary to operate the property. It doesnotinclude debt service (mortgage payments). A higher NOI indicates a more profitable property. After calculating NOI, you can then figure out the Cash Flow Before Taxes (CFBT). CFBT is simply the NOI minus the debt service. This represents the cash flow you have available before paying income taxes. The formula is: CFBT = NOI – Debt Service. If the result is positive, your property is generating positive cash flow before taxes. If it's negative, your property is operating at a loss. Another important metric is Capitalization Rate (Cap Rate). The cap rate is a measure of a property's potential rate of return. It's calculated by dividing the NOI by the current market value of the property: Cap Rate = NOI / Property Value. A higher cap rate generally indicates a more attractive investment opportunity, but it's important to compare cap rates to similar properties in the same market. Cash on Cash Return measures the return on the actual cash you invested in the property. This is calculated by dividing your Cash Flow Before Taxes by the total cash invested: Cash on Cash Return = CFBT / Total Cash Invested. Total cash invested includes your down payment, closing costs, and any initial repair or renovation expenses. Another important thing to consider is Break-Even Occupancy Rate. This is the occupancy rate required to cover all operating expenses and debt service. It is calculated by dividing total operating expenses plus debt service by gross potential income.

Tips for Real Estate Investment Cash Flow Analysis

Be meticulous with your data. The accuracy of your cash flow analysis depends on the quality of the data you use. Double-check your numbers and make sure you're using reliable sources. Don't rely solely on online calculators. While online calculators can be helpful, they often make assumptions that may not be accurate for your specific situation. Always do your own analysis. Understand the nuances of your local market. Rental rates, vacancy rates, and property values can vary significantly from one area to another. Research your local market thoroughly. Consider the long-term implications. Real estate investing is a long-term game. Think about how your cash flow might change over time. Factor in potential rent increases, property appreciation, and changes in expenses. Get multiple quotes for services. Don't settle for the first quote you receive for insurance, property management, or repairs. Shop around and compare prices to get the best deals. Conduct regular property inspections. Regular inspections can help you identify potential maintenance issues early on, before they become major problems. This can save you money on repair costs in the long run. Build relationships with local contractors. Having a reliable network of contractors can be invaluable when you need repairs or renovations done quickly and efficiently. Understand the tax implications of real estate investing. Real estate investments can have significant tax benefits, but it's important to understand the rules and regulations. Consult with a tax professional. Review your insurance coverage. Make sure you have adequate insurance coverage to protect your property from damage or liability. Prepare for the unexpected. Have a contingency plan in place for dealing with unexpected vacancies, repairs, or other challenges. Don't be afraid to negotiate. Negotiate the purchase price, rental rates, and other terms to improve your cash flow. Stay informed. Keep up-to-date on the latest trends and developments in the real estate market.

Using Technology to Streamline Your Analysis

Technology offers powerful tools to streamline and enhance real estate investment cash flow analysis. Spreadsheet programs like Microsoft Excel or Google Sheets are fundamental for organizing and calculating financial data. You can create custom templates tailored to your specific needs, inputting income, expenses, and mortgage details. These programs allow for easy manipulation of data and creation of various scenarios. There are also specialized real estate analysis software options available. These programs often offer features such as automated data import, built-in calculators, and detailed reports. Some popular options include Rentometer, Bigger Pockets, and Deal Check. Online rental calculators can provide quick estimates of potential cash flow, but they should be used with caution. These calculators often rely on general assumptions and may not be accurate for your specific property. They are best used for initial screening, not for making final investment decisions. Cloud-based platforms enable you to access your cash flow analysis from anywhere, collaborate with partners, and securely store your data. Some platforms also offer mobile apps, allowing you to manage your investments on the go. Data visualization tools can help you present your cash flow analysis in a clear and compelling way. Charts and graphs can make it easier to identify trends and patterns. Automation can save you time and reduce errors. You can automate tasks such as data entry, report generation, and sensitivity analysis. Remember to backup your data regularly. Whether you're using a spreadsheet or specialized software, it's important to protect your data from loss or corruption. Store your data in multiple locations, including a cloud-based backup. Keep your software up-to-date. Software updates often include security patches and bug fixes. Keeping your software up-to-date will help protect your data and ensure that you're using the latest features.

Fun Facts About Real Estate Investment Cash Flow Analysis

Did you know that the first real estate investment trusts (REITs) were created in the United States in the 1960s? REITs allowed small investors to participate in large-scale real estate projects and receive regular cash flow. Cash flow analysis can help you determine whether a property qualifies for a 1031 exchange, a tax-deferred strategy that allows you to reinvest the proceeds from the sale of one property into another similar property. Many successful real estate investors start small, focusing on generating positive cash flow from a single rental property. Over time, they reinvest their profits to acquire more properties and build a diversified portfolio. The "BRRRR" strategy (Buy, Rehab, Rent, Refinance, Repeat) relies heavily on cash flow analysis to ensure that each property generates enough income to cover expenses and fund future investments. Cash flow analysis can help you identify properties that are undervalued or distressed, offering the potential for higher returns. Some investors use cash flow analysis to identify properties that are suitable for short-term rentals, such as Airbnb. Short-term rentals can generate higher income than traditional long-term rentals, but they also come with higher management costs. Cash flow analysis can help you determine whether the potential benefits outweigh the risks. There are entire online communities dedicated to real estate investment cash flow analysis, with investors sharing tips, strategies, and resources. Many real estate investors use cash flow analysis to create a financial plan and achieve their long-term goals, such as retirement or financial independence. One of the most important lessons in real estate investing is that "cash is king." Cash flow analysis helps you understand how much cash your properties are generating and make informed decisions about your investments. Fun Fact: Some properties have even been known to generate enough passive income to buymoreproperties. Think of the snowball effect!

How to Perform Real Estate Investment Cash Flow Analysis

Performing a real estate investment cash flow analysis involves a systematic approach to evaluating the financial performance of a property. First, gather your data. This includes information on the property's purchase price, mortgage details, potential rental income, and all associated expenses. Accurately estimating expenses is key. Common expenses include: Mortgage payments (principal and interest), Property taxes, Insurance (hazard, flood, etc.), Property management fees, Maintenance and repairs, Vacancy allowance (typically 5-10% of gross rent), and Utilities (if included in rent). Next, calculate the Gross Potential Income (GPI). This is the total rental income the property could generate if it were 100% occupied. Then, estimate the vacancy rate. This is the percentage of time the property is likely to be vacant. Multiply the GPI by the vacancy rate to calculate the vacancy loss. Now, calculate the Effective Gross Income (EGI). This is the GPI minus the vacancy loss: EGI = GPI - Vacancy Loss. Following that, determine the operating expenses. These are the expenses necessary to operate the property, such as property taxes, insurance, and maintenance. Donotinclude mortgage payments in operating expenses. Calculate the Net Operating Income (NOI). This is the EGI minus the operating expenses: NOI = EGI - Operating Expenses. After that, factor in the debt service. This is the total amount of principal and interest you pay on your mortgage each year. Calculate the Cash Flow Before Taxes (CFBT). This is the NOI minus the debt service: CFBT = NOI - Debt Service. Finally, analyze your results. If the CFBT is positive, the property is generating positive cash flow. If it's negative, the property is generating negative cash flow. It's also important to consider other factors, such as appreciation potential and tax benefits, before making a final investment decision. Consider using a spreadsheet or real estate analysis software to streamline this process and maintain accuracy.

What If Your Real Estate Investment Cash Flow is Negative?

So, what happens if your real estate investment cash flow analysis reveals a negative cash flow? Don't panic! It's not necessarily a deal-breaker. It simply means that the property's income is not currently covering all of its expenses. There are several strategies you can employ to turn things around. First, re-evaluate your rental rate. Is your rent too low? Research comparable properties in your area to see if you can raise your rent without losing tenants. Be mindful of market rates and tenant retention. Negotiate with your lender. If your mortgage payments are too high, see if you can refinance your loan at a lower interest rate or extend the loan term. This can significantly reduce your monthly payments and improve your cash flow. Cut expenses wherever possible. Review your operating expenses and identify areas where you can save money. For example, you might be able to negotiate lower insurance premiums or find a cheaper property management company. Consider performing renovations. Improvements can increase the property's rental value and attract higher-paying tenants. However, be sure to factor in the cost of renovations when evaluating your cash flow. Implement value-added services. Consider offering additional services to tenants, such as laundry facilities, storage units, or parking spaces. You can charge extra for these services, which can increase your income. Explore different financing options. Consider using a different financing strategy, such as a hard money loan or a private lender, to improve your cash flow. However, be sure to carefully evaluate the risks and benefits of each option. Focus on tenant retention. Vacancy is one of the biggest threats to cash flow. Make sure your tenants are happy and satisfied so they will renew their leases. Address any complaints or concerns promptly and professionally. Be prepared to subsidize the property. If all else fails, you may need to subsidize the property with your own funds until you can improve the cash flow. However, this is not a sustainable long-term solution. Monitor your cash flow closely. Regularly review your cash flow projections and make adjustments as needed to reflect changing market conditions and property expenses. If negative cash flow persists despite your efforts, it might be time to consider selling the property.

Listicle of Real Estate Investment Cash Flow Analysis

Here's a listicle highlighting essential aspects of real estate investment cash flow analysis: 1. Understand the Basics: Grasp the core concept of cash flow – income minus expenses.

2. Gather Accurate Data: Collect precise information on rental rates, expenses, and financing terms.

3. Estimate Expenses Realistically: Account for all potential costs, including maintenance, repairs, and vacancy.

4. Calculate Gross Potential Income (GPI): Determine the maximum possible rental income with 100% occupancy.

5. Factor in Vacancy: Estimate vacancy rates and subtract the vacancy loss from GPI.

6. Calculate Effective Gross Income (EGI): Subtract the vacancy loss from GPI.

7. Determine Operating Expenses: Identify and sum all operating expenses, excluding debt service.

8. Calculate Net Operating Income (NOI): Subtract operating expenses from EGI.

9. Factor in Debt Service: Consider the mortgage payments, including principal and interest.

10. Calculate Cash Flow Before Taxes (CFBT): Subtract debt service from NOI.

11. Analyze Your Results: Evaluate whether the cash flow is positive or negative.

12. Conduct Sensitivity Analysis: Test how changes in assumptions affect cash flow.

13. Seek Professional Advice: Consult with a real estate accountant or financial advisor.

14. Use Technology Wisely: Leverage spreadsheets and software to streamline analysis.

15. Continuously Monitor and Adjust: Regularly review cash flow and update projections.

16. Focus on Value-Added Services: Add amenities to increase income.

17. Negotiate Terms: Get the best purchase price and financing rates.

18. Minimize Vacancy: Prioritize tenant retention.

19. Control Expenses: Find ways to reduce costs.

20. Be Prepared for the Unexpected: Build a reserve fund for emergencies.

Question and Answer Section on Real Estate Investment Cash Flow Analysis

Here are some common questions and answers about real estate investment cash flow analysis:

Q: What's the difference between Net Operating Income (NOI) and Cash Flow Before Taxes (CFBT)?

A: NOI represents the property's profitability before considering debt service (mortgage payments), while CFBT represents the actual cash flow you have available after paying the mortgage.

Q: What's a good vacancy rate to use in my cash flow analysis?

A: A good rule of thumb is to use a vacancy rate of 5-10%, but it can vary depending on the location and type of property. Research vacancy rates in your area to get a more accurate estimate.

Q: How can I improve the cash flow of a property with negative cash flow?

A: You can improve cash flow by raising rents, cutting expenses, refinancing your mortgage, performing renovations, or adding value-added services.

Q: What are some common mistakes to avoid when performing cash flow analysis?

A: Common mistakes include underestimating expenses, overestimating rental income, failing to account for vacancy, and not considering the long-term implications.

Conclusion of Real Estate Investment Cash Flow Analysis

Mastering real estate investment cash flow analysis is not just about crunching numbers; it's about empowering yourself to make informed and profitable decisions. By understanding the nuances of income, expenses, and market conditions, you can transform your real estate ventures from potential liabilities into reliable sources of wealth. Remember to be meticulous, realistic, and proactive in your approach. Stay informed, adapt to changing market dynamics, and always prioritize the long-term financial health of your investments. With a solid grasp of cash flow analysis, you'll be well-equipped to navigate the complexities of the real estate market and achieve your financial goals.

Post a Comment