real estate investment market comparable

Imagine trying to navigate a bustling marketplace blindfolded. That's what investing in real estate can feel like without a solid understanding of market comparables. You're essentially making huge financial decisions without knowing what similar properties are selling for, leaving you vulnerable to overpaying, underselling, or simply missing out on lucrative opportunities. Sound familiar?

Many investors find themselves struggling to accurately assess the value of properties. They may rely on outdated information, gut feelings, or advice from biased sources. This often leads to missed opportunities, financial losses, and a general sense of uncertainty when navigating the real estate landscape.

The goal is to empower real estate investors with the knowledge and tools they need to make informed decisions. We aim to demystify the process of analyzing market comparables, equipping you with the ability to confidently evaluate properties, negotiate effectively, and maximize your return on investment.

This article will delve into the world of real estate market comparables, exploring what they are, how to find them, and how to use them to your advantage. We'll cover essential techniques, address common misconceptions, and offer practical tips to help you become a savvy real estate investor. By mastering the art of market analysis, you'll be well-positioned to make sound investments and achieve your financial goals. Key words: real estate, investment, market, comparables, analysis, valuation, properties.

Understanding the Importance of Real Estate Investment Market Comparables

My first real estate investment was a rollercoaster. I was so excited about the potential of this charming fixer-upper, I jumped in headfirst, relying more on emotion than data. I didn't fully grasp the importance of market comparables. I ended up overpaying significantly, and it took much longer than anticipated to see any return on my investment. It was a costly lesson, but one that solidified the critical role of comps in the real estate world. Real estate investment market comparables, often called "comps," are similar properties that have recently sold in the same area as the property you're evaluating. Analyzing these sales provides a benchmark for determining the fair market value of your target property. This isn't just about finding a number; it's about understanding the nuances of the local market, identifying trends, and making informed decisions based on concrete data rather than assumptions. A thorough comparative market analysis (CMA) considers factors like location, size, age, condition, amenities, and recent renovations. Each of these elements can influence a property's value, and understanding their relative importance is key to accurate valuation. By using comps effectively, you can avoid overpaying, identify undervalued opportunities, and negotiate with confidence. Keywords: comparative market analysis, CMA, property valuation, fair market value, real estate trends, negotiation, investment strategy.

What Exactly are Real Estate Investment Market Comparables?

At its core, a real estate investment market comparable is a recently sold property that shares key characteristics with the one you're interested in. Think of it as a real-world example that helps you understand the price tag of similar offerings in the market. The closer the comparable is to your target property in terms of location, size, age, condition, and features, the more reliable it is as a data point. Essentially, real estate investment market comparables are similar properties that have recently sold in the same area as the property you're evaluating. Analyzing these sales provides a benchmark for determining the fair market value of your target property. This isn't just about finding a number; it's about understanding the nuances of the local market, identifying trends, and making informed decisions based on concrete data rather than assumptions. A thorough comparative market analysis (CMA) considers factors like location, size, age, condition, amenities, and recent renovations. Each of these elements can influence a property's value, and understanding their relative importance is key to accurate valuation. By using comps effectively, you can avoid overpaying, identify undervalued opportunities, and negotiate with confidence. Keywords: comparative market analysis, CMA, property valuation, fair market value, real estate trends, negotiation, investment strategy.

The History and Myths Surrounding Real Estate Investment Market Comparables

The concept of using comparable sales to value real estate isn't new. It's been around for centuries, evolving from simple observations to sophisticated data analysis techniques. In the past, real estate professionals relied on handwritten records and local knowledge to determine property values. With the advent of technology and online databases, accessing and analyzing market data has become significantly easier. However, some myths persist about comparables. One common misconception is that any recently sold property in the same neighborhood is a good comp. This isn't necessarily true. A valid comp must be similar in terms of key characteristics and adjusted accordingly for any differences. Another myth is that the average price of several comps is the "true" value of the property. While averaging comps can provide a general idea, a more nuanced analysis is required to account for variations and weigh the importance of different factors. The history of real estate investment market comparables is intertwined with the evolution of data collection and analysis. From rudimentary methods to sophisticated algorithms, the goal remains the same: to provide a reliable basis for determining property value. By understanding the historical context and debunking common myths, investors can approach market analysis with greater clarity and confidence. Keywords: property valuation history, CMA myths, data analysis in real estate, real estate market trends, investment decision-making.

The Hidden Secrets of Real Estate Investment Market Comparables

The real power of market comparables lies not just in finding them, but in understanding how to interpret them effectively. One often-overlooked secret is the importance of making adjustments. No two properties are exactly alike, so you need to account for the differences between the comparable properties and the one you're evaluating. For example, if a comparable property has a renovated kitchen and yours doesn't, you'll need to adjust the comparable's sale price downward to reflect this difference. Another hidden secret is the value of exploring off-market comparables. While publicly available data is helpful, networking with real estate agents and other investors can uncover insights into private sales that may not be readily accessible. Understanding the motivations behind recent sales can also provide valuable context. Was the seller under pressure to move quickly? Was there a bidding war that drove the price up? These factors can influence the sale price and should be considered when analyzing comparables. The hidden secrets of real estate investment market comparables involve going beyond the surface-level data and digging deeper to understand the underlying factors that influence property values. By mastering the art of adjustments, exploring off-market data, and understanding seller motivations, you can gain a significant edge in the real estate market. Keywords: property adjustments, off-market deals, real estate networking, seller motivation, market insights, investment advantage.

Recommendations for Effectively Utilizing Real Estate Investment Market Comparables

My top recommendation is to be meticulous in your research. Don't settle for the first few comps you find. Explore multiple sources, verify the accuracy of the data, and don't be afraid to ask questions. Another crucial recommendation is to understand the nuances of the local market. Each neighborhood has its own unique characteristics and trends. What's selling well in one area may not be as desirable in another. Networking with local real estate agents and investors can provide invaluable insights into these local market dynamics. It's also essential to stay up-to-date on current market trends. Real estate markets are constantly evolving, and what was true six months ago may no longer be relevant today. Regularly monitor market data, attend industry events, and stay informed about changes in interest rates, zoning regulations, and other factors that can influence property values. Recommendations for effectively utilizing real estate investment market comparables include thorough research, understanding local market dynamics, staying up-to-date on current trends, and networking with industry professionals. By following these recommendations, you can make informed investment decisions and maximize your returns in the real estate market. Keywords: real estate research, local market expertise, market trends analysis, industry networking, investment strategy optimization.

Practical Steps for Finding and Analyzing Real Estate Investment Market Comparables

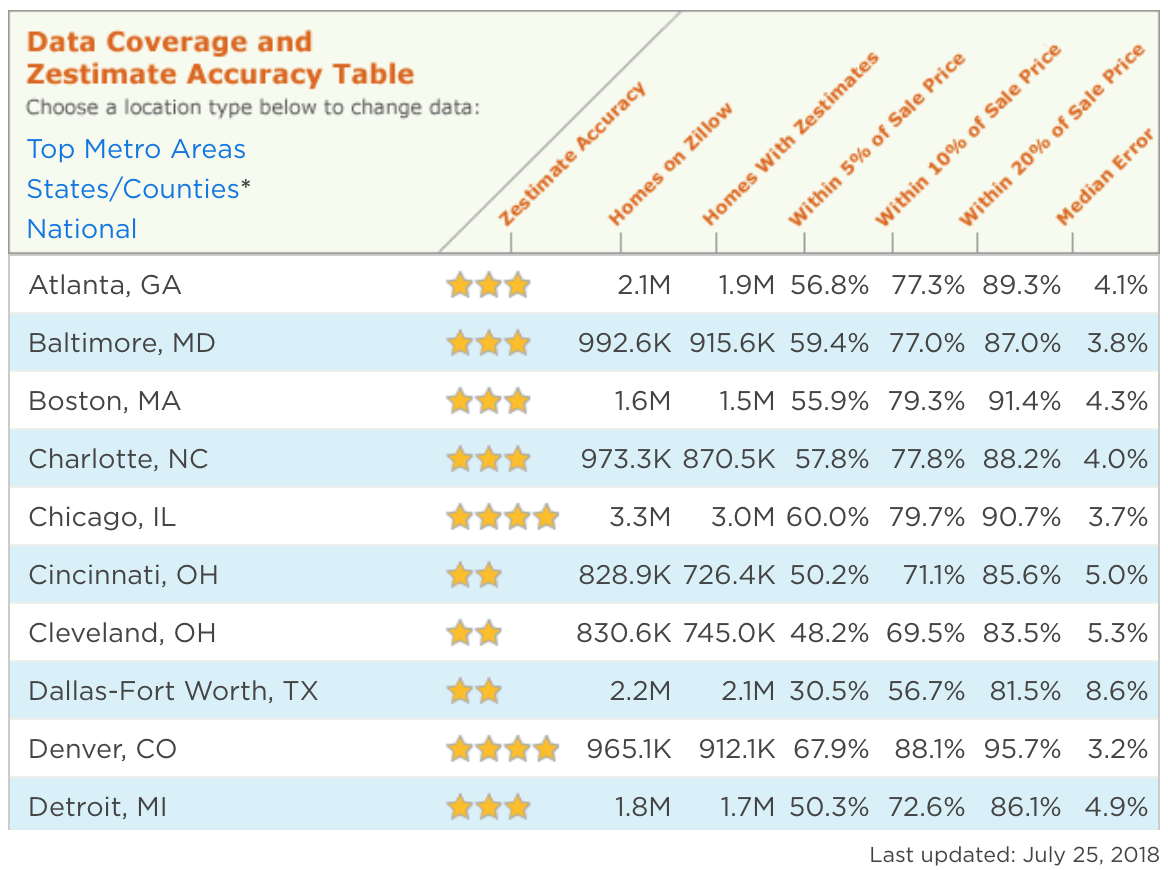

Finding reliable comparables starts with knowing where to look. Online real estate databases like Zillow, Realtor.com, and Redfin are excellent starting points. These platforms provide access to a wealth of property data, including recent sales information. However, it's important to verify the accuracy of this data, as it may not always be completely up-to-date or accurate. Another valuable resource is the local Multiple Listing Service (MLS). The MLS is a database of properties listed for sale by real estate agents. It contains more detailed information than publicly available databases and is generally considered to be more accurate. To access the MLS, you'll typically need to work with a licensed real estate agent. Once you've gathered a list of potential comparables, the next step is to analyze them carefully. Look for properties that are similar to your target property in terms of location, size, age, condition, features, and amenities. Pay attention to the sale prices and the dates of the sales. The more recent the sale, the more relevant it is as a comparable. Practical steps for finding and analyzing real estate investment market comparables include utilizing online databases, accessing the MLS, verifying data accuracy, comparing property characteristics, analyzing sale prices and dates, and adjusting for differences. By following these steps, you can gather reliable data and make informed decisions about property values. Keywords: online real estate databases, MLS access, data verification, property comparison, sale price analysis, adjustment techniques.

Tips for Fine-Tuning Your Real Estate Investment Market Comparable Analysis

One of the most important tips is to be objective in your analysis. It's easy to let your emotions cloud your judgment, especially if you're particularly fond of a property. However, it's crucial to base your valuation on data rather than feelings. Another helpful tip is to use a weighted scoring system to compare properties. Assign points to different characteristics based on their relative importance. For example, location might be worth more points than a renovated bathroom. This can help you objectively assess the similarities and differences between properties. It's also important to consider the overall market conditions. Is it a buyer's market or a seller's market? Are interest rates rising or falling? These factors can influence property values and should be taken into account when analyzing comparables. Tips for fine-tuning your real estate investment market comparable analysis include maintaining objectivity, using a weighted scoring system, considering market conditions, verifying data accuracy, adjusting for differences, and seeking expert advice. By following these tips, you can improve the accuracy and reliability of your analysis and make more informed investment decisions. Keywords: objective valuation, weighted scoring, market conditions analysis, data verification, adjustment strategies, expert consultation.

Common Pitfalls to Avoid When Using Real Estate Investment Market Comparables

One common pitfall is relying on outdated data. Real estate markets can change quickly, so it's important to use the most recent sales information available. Ideally, you should focus on sales that have occurred within the past six months. Another mistake is failing to adjust for differences between properties. As mentioned earlier, no two properties are exactly alike, so you need to account for any variations in terms of size, condition, features, and amenities. Ignoring these differences can lead to inaccurate valuations. It's also important to be wary of outliers. If one comparable property sold for significantly more or less than other similar properties, it may not be a reliable data point. There could be unique circumstances that influenced the sale price, such as a desperate seller or a bidding war. Common pitfalls to avoid when using real estate investment market comparables include relying on outdated data, failing to adjust for differences, ignoring outliers, using too few comparables, neglecting market conditions, and allowing emotions to cloud judgment. By being aware of these pitfalls, you can avoid making costly mistakes and improve the accuracy of your analysis. Keywords: outdated data, adjustment errors, outlier identification, sample size, market condition awareness, emotional bias.

Fun Facts About Real Estate Investment Market Comparables

Did you know that the term "comps" originated from the appraisal industry? Appraisers have been using comparable sales to determine property values for decades. Another interesting fact is that the accuracy of market comparables has a direct impact on the mortgage approval process. Lenders rely on appraisals to ensure that the property is worth the amount being borrowed. If the appraisal comes in lower than the purchase price, the buyer may need to come up with additional funds or renegotiate the deal. Market comparables are also used in tax assessments. Local governments use comparable sales data to determine the assessed value of properties, which is used to calculate property taxes. The more accurate the data, the fairer the tax assessments will be. Fun facts about real estate investment market comparables include their origin in the appraisal industry, their impact on mortgage approvals, their use in tax assessments, their influence on negotiation strategies, and their role in identifying market trends. By understanding these fun facts, you can gain a greater appreciation for the importance and versatility of market comparables. Keywords: appraisal history, mortgage financing, property tax assessment, negotiation tactics, market trend identification.

How to Find Real Estate Investment Market Comparables Like a Pro

The key to finding great comparables is to be persistent and resourceful. Start by leveraging online real estate databases and the MLS. Use advanced search filters to narrow down your results and focus on properties that are as similar as possible to your target property. Don't be afraid to reach out to local real estate agents and ask for their assistance. They often have access to off-market data and can provide valuable insights into the local market. Attend local real estate events and network with other investors. They may be able to share tips and resources that you haven't discovered yet. Consider hiring a professional appraiser to conduct a comparative market analysis. Appraisers have specialized training and experience in property valuation and can provide an objective and reliable assessment of market value. How to find real estate investment market comparables like a pro involves leveraging online resources, accessing the MLS, networking with real estate professionals, attending industry events, and considering professional appraisals. By following these steps, you can gather comprehensive data and make informed investment decisions. Keywords: online resources, MLS access, real estate networking, industry events, professional appraisals.

What If Real Estate Investment Market Comparables Are Scarce?

Sometimes, finding comparable properties can be challenging, especially in unique or niche markets. If you're dealing with a one-of-a-kind property or a rapidly changing market, you may need to get creative in your approach. One strategy is to broaden your search area. Look for comparable properties in neighboring neighborhoods or towns. However, be sure to account for any differences in location and adjust your valuation accordingly. Another approach is to look further back in time. While recent sales are generally preferred, you may need to consider older sales if there aren't enough recent comparables available. Be sure to adjust for any changes in market conditions that have occurred since the older sales took place. Consider using alternative valuation methods, such as the income approach or the cost approach. These methods rely on different factors to determine property value and can be helpful when comparable sales data is limited. What if real estate investment market comparables are scarce? The solutions include broadening the search area, considering older sales, using alternative valuation methods, seeking expert advice, and focusing on property characteristics. By adapting your approach to the specific circumstances, you can still arrive at a reasonable estimate of market value. Keywords: limited comparables, broader search area, older sales data, alternative valuation methods, expert consultation.

Listicle: Top 5 Things to Know About Real Estate Investment Market Comparables

1. Comparables are recently sold properties that are similar to your target property.

2. Accurate comparables are essential for determining fair market value.

3. Adjustments must be made for differences between properties.

4. Local market knowledge is crucial for effective analysis.

5. Reliable data sources include online databases, the MLS, and real estate professionals. Top 5 things to know about real estate investment market comparables: definition, importance, adjustments, local knowledge, and data sources. By understanding these key concepts, you can confidently navigate the world of real estate valuation and make informed investment decisions. Keywords: key concepts, property valuation, adjustments, local knowledge, data sources.

Question and Answer about real estate investment market comparable

Q: What is the ideal number of comparable properties to use in an analysis?

A: Aim for at least three to five comparables to get a reliable range of values. More comparables can provide a more comprehensive picture, but focus on quality over quantity.

Q: How do I adjust for differences between properties?

A: Identify the key differences (e.g., size, condition, amenities) and estimate the value of each difference based on local market data. Add or subtract these values from the comparable's sale price to arrive at an adjusted value.

Q: What if I can't find any truly comparable properties?

A: Broaden your search area, consider older sales, and use alternative valuation methods. Consult with a local real estate expert for guidance.

Q: How often should I update my comparable analysis?

A: Update your analysis regularly, especially in rapidly changing markets. Aim to review your comparables at least every three to six months to stay informed of current market trends.

Conclusion of real estate investment market comparable

Understanding real estate investment market comparables is paramount for success in the real estate world. By mastering the art of finding, analyzing, and adjusting comps, you can make informed investment decisions, negotiate effectively, and maximize your returns. So, embrace the power of data, stay curious, and always be willing to learn and adapt as the market evolves.

Post a Comment