real estate investment income approach

Ever wonder how the pros figure out if a real estate investment is actually worth the money? It's not just about curb appeal and granite countertops, it's about the numbers, specifically how much income a property can generate. That's where the income approach comes in, and it's more crucial than you might think.

For many, navigating the world of real estate investment feels like wandering through a financial minefield. There are concerns about overpaying, not factoring in all expenses, or simply misjudging the true earning potential of a property. It's easy to get caught up in the excitement of a potential deal and overlook critical details that could make or break your investment.

The real estate investment income approach aims to provide a more data-driven method for estimating the fair market value of a property, primarily focusing on its revenue-generating capacity rather than relying solely on comparable sales data. It's a tool to help make informed decisions.

This guide will explore the ins and outs of the income approach to real estate investment. We'll demystify key concepts such as net operating income (NOI), capitalization rates (cap rates), and gross rent multipliers (GRM), showing you how to use these tools to confidently assess a property's true value. You'll learn how to apply these principles in real-world scenarios and avoid common pitfalls along the way. Keywords: real estate investment, income approach, NOI, cap rate, GRM, property valuation.

What is the Goal?

The ultimate goal of the income approach in real estate is to determine a property's present value based on its anticipated future income stream. It's a shift from focusing on what similar properties have sold for (the sales comparison approach) or how much it would cost to rebuild (the cost approach). Instead, it asks: "How much money will this property generate, and is that worth the asking price?" I remember when I first started looking at investment properties, I was solely focused on location and aesthetics. I found a charming Victorian duplex in a trendy neighborhood and was ready to make an offer. Luckily, a seasoned investor friend pulled me aside and asked, "Have you run the numbers?" I sheepishly admitted I hadn't. He walked me through calculating the potential rental income, subtracting operating expenses, and finding the net operating income (NOI). Then, he showed me how to use a capitalization rate to estimate the property's value based on its income. That conversation was a wake-up call. I realized I was about to make a purely emotional decision, ignoring the financial realities. By using the income approach, I discovered that while the duplex was beautiful, its earning potential didn't justify the asking price. I walked away from that deal, and it was one of the smartest decisions I ever made. The income approach is particularly valuable for income-producing properties like apartment buildings, office spaces, retail centers, and industrial warehouses. It's also useful when comparable sales data is limited or unreliable. The income approach's key is to convert a property's income into an estimate of value, considering factors like risk, return, and market conditions. Understanding these principles allows investors to make more informed decisions and avoid costly mistakes.

Understanding the Core Concepts

At its heart, the income approach hinges on the idea that a property's value is directly related to the income it can generate. To put it simply, a property that produces a large and consistent income stream is worth more than one that produces little or no income. Several key concepts are crucial to understanding and applying the income approach. Net Operating Income (NOI) is the most fundamental element. It's calculated by subtracting all operating expenses from the gross operating income. Operating expenses include things like property taxes, insurance, maintenance, and management fees. Capitalization Rate (Cap Rate) is the rate of return an investor can expect on a real estate investment. It's calculated by dividing the NOI by the property's value or price. A higher cap rate generally indicates a higher risk, while a lower cap rate suggests a lower risk. Gross Rent Multiplier (GRM) is a simpler valuation method that compares a property's price to its gross rental income. It's calculated by dividing the property's price by its annual gross rental income. While easier to calculate than NOI and cap rate, GRM is less precise because it doesn't account for operating expenses. Vacancy Rate is another important factor. It represents the percentage of units in a property that are vacant and not generating income. A higher vacancy rate can significantly reduce a property's NOI and value. By understanding and applying these concepts, investors can gain a more accurate picture of a property's true worth and make more informed investment decisions.

History and Myths

The income approach to real estate valuation isn't some newfangled invention; it has roots stretching back decades. Its formalization and widespread adoption, however, have evolved alongside the increasing sophistication of real estate finance. Early applications were relatively simple, focusing primarily on net income and rule-of-thumb multipliers. Over time, more complex methods were developed to account for factors like depreciation, tax implications, and varying risk levels. Today, the income approach is a cornerstone of commercial real estate valuation, used by appraisers, investors, and lenders alike. Despite its widespread use, several myths surround the income approach. One common myth is that it's only applicable to commercial properties. While it's most frequently used for income-producing properties like apartments and office buildings, the income approach can also be applied to residential properties, particularly those used as rentals. Another myth is that the income approach is always the most accurate valuation method. The truth is that the most appropriate valuation method depends on the specific property and market conditions. In some cases, the sales comparison approach may be more reliable, especially when there are plenty of comparable sales data available. A third myth is that a high cap rate always means a good investment. While a high cap rate may indicate a potentially high return, it can also signal higher risk. It's crucial to carefully analyze the underlying factors driving the cap rate, such as the property's condition, location, and tenant quality. By debunking these myths, investors can gain a more realistic understanding of the income approach and use it effectively in their investment decisions.

Hidden Secrets

The income approach, while seemingly straightforward, has nuances that separate seasoned investors from the novices. One often overlooked aspect is the importance of accurate expense projections. Many investors underestimate operating expenses, leading to an inflated NOI and an unrealistic valuation. It's crucial to conduct thorough due diligence, reviewing historical expense data and factoring in potential future costs like repairs and capital improvements. Another secret lies in understanding the local market conditions. Cap rates vary significantly depending on location, property type, and overall economic climate. A cap rate that's considered good in one market may be subpar in another. It's essential to research local market trends and benchmark cap rates against comparable properties. Furthermore, creative financing strategies can significantly impact the profitability of an investment property. By leveraging debt effectively, investors can increase their return on equity and boost their overall investment performance. However, it's crucial to carefully assess the risks associated with debt and ensure that the property's income can comfortably cover debt service payments. Finally, networking with experienced investors and industry professionals can provide valuable insights and access to off-market deals. Building relationships with appraisers, brokers, and property managers can give you a competitive edge and help you navigate the complexities of real estate investing. By uncovering these hidden secrets, you can unlock the full potential of the income approach and achieve greater success in your real estate ventures.

Recommendations

If you're serious about using the income approach to evaluate real estate investments, here's some practical advice to get you started. First and foremost, invest in education. Take courses, read books, and attend seminars to deepen your understanding of real estate finance and valuation. There are numerous resources available online and in person, so take advantage of them. Second, practice, practice, practice. Start by analyzing properties in your local market, even if you're not planning to invest in them. Calculate the NOI, cap rate, and GRM, and compare your results to those of professional appraisers or brokers. This will help you hone your skills and develop your intuition. Third, build a network of trusted advisors. Surround yourself with experienced investors, real estate agents, lenders, and attorneys who can provide guidance and support. Their expertise can be invaluable, especially when you're facing complex decisions. Fourth, use technology to your advantage. There are many software tools and online calculators that can streamline the valuation process. These tools can help you quickly analyze properties, compare different investment scenarios, and identify potential risks and opportunities. Fifth, always conduct thorough due diligence. Don't rely solely on the information provided by the seller or broker. Verify all income and expense data, inspect the property thoroughly, and research local market conditions. By following these recommendations, you can increase your chances of success and make more informed investment decisions.

Common Pitfalls

Even with a solid understanding of the income approach, it's easy to fall into common traps that can lead to inaccurate valuations and poor investment decisions. One of the biggest pitfalls is relying on outdated or inaccurate data. Make sure you're using the most current information available, including recent sales comparables, market reports, and expense data. Another common mistake is failing to account for deferred maintenance. Neglecting to factor in the cost of necessary repairs and upgrades can significantly overstate a property's value. Always inspect the property thoroughly and obtain professional estimates for any required work. Overestimating rental income is another frequent error. It's important to conduct a market analysis to determine the appropriate rental rates for the property and factor in vacancy rates. Don't assume that you can simply charge whatever you want. Ignoring capital expenditures (CAPEX) can also be a costly mistake. CAPEX refers to major expenses that are required to maintain or improve the property, such as roof replacements, HVAC upgrades, and new appliances. These expenses can significantly impact the property's NOI and value. Underestimating management fees is another common oversight. Property management can be time-consuming and demanding, so it's important to factor in the cost of hiring a professional property manager or allocating sufficient time and resources to manage the property yourself. Finally, failing to consider the impact of taxes can skew your valuation. Property taxes, income taxes, and capital gains taxes can all affect your investment returns. It's important to consult with a tax advisor to understand the tax implications of your real estate investments. By being aware of these common pitfalls, you can avoid costly mistakes and make more informed investment decisions.

Tips and Tricks

Beyond the basic formulas and concepts, there are several tips and tricks that can help you refine your use of the income approach and gain a competitive edge. First, always verify the seller's financial information. Don't just take their word for it. Request detailed income statements, expense reports, and rent rolls. Scrutinize the data for any inconsistencies or anomalies. Second, look for hidden income streams. In addition to rental income, many properties have potential for additional income from sources like parking fees, laundry facilities, vending machines, or storage units. Identifying and capitalizing on these hidden income streams can significantly boost your investment returns. Third, negotiate aggressively. Don't be afraid to make a low offer, especially if you've identified potential problems with the property or its financials. The seller may be willing to negotiate to avoid losing the deal. Fourth, consider the potential for value appreciation. While the income approach focuses on current income, it's important to also consider the potential for the property to increase in value over time. Factors like location, market trends, and planned developments can all impact appreciation potential. Fifth, think long-term. Real estate investing is a long-term game, so it's important to take a long-term view of your investments. Don't focus solely on short-term profits. Instead, look for properties that have the potential to generate sustainable income and appreciate in value over time. By incorporating these tips and tricks into your investment strategy, you can increase your chances of success and build a profitable real estate portfolio.

The Impact of Interest Rates

Interest rates play a crucial role in real estate investment, particularly when using the income approach. Changes in interest rates can significantly affect both the cost of financing and the capitalization rates used to value properties. When interest rates rise, the cost of borrowing money increases, making it more expensive to finance real estate investments. This can lead to lower demand for properties and potentially depress property values. Higher interest rates also tend to push capitalization rates upward. As investors demand a higher return to compensate for the increased cost of borrowing, they are willing to pay less for properties, resulting in higher cap rates. Conversely, when interest rates fall, the cost of borrowing decreases, making it more affordable to finance real estate investments. This can lead to increased demand for properties and potentially drive up property values. Lower interest rates also tend to push capitalization rates downward. As investors are willing to accept a lower return due to the decreased cost of borrowing, they are willing to pay more for properties, resulting in lower cap rates. Therefore, it's essential to carefully monitor interest rate trends and factor them into your real estate investment analysis. Keep an eye on the Federal Reserve's monetary policy decisions and economic indicators that can influence interest rates. Also, consider stress-testing your investment scenarios to see how changes in interest rates could impact your returns. By understanding the impact of interest rates, you can make more informed investment decisions and mitigate potential risks.

Fun Facts

Did you know that the Empire State Building was once considered a white elephant? After its completion in 1931, it struggled to attract tenants and was often referred to as the "Empty State Building." It wasn't until after World War II that the building finally reached full occupancy. Another interesting fact is that the capitalization rate (cap rate) is not just a real estate metric. It's also used in other areas of finance to evaluate the profitability of investments. For example, it can be used to assess the value of a business or a piece of equipment. The highest cap rates are typically found in emerging markets or in areas with high levels of risk. These markets offer the potential for high returns, but also come with greater uncertainty. The lowest cap rates are typically found in stable, developed markets with low levels of risk. These markets offer more predictable returns, but also tend to have lower growth potential. Real estate is one of the oldest forms of investment, dating back to ancient times. Throughout history, people have recognized the value of land and property as a store of wealth and a source of income. Some of the most famous real estate investors of all time include Donald Trump, Sam Zell, and Harry Helmsley. These individuals have built vast empires through shrewd investments and a deep understanding of the real estate market. By learning from their successes (and mistakes), you can improve your own investment skills and achieve your financial goals.

How to Analyze a Property

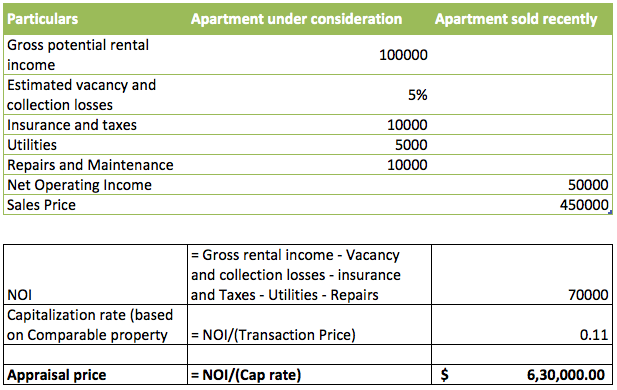

Now, let's walk through a practical example of how to analyze a property using the income approach. Suppose you're considering purchasing an apartment building with 20 units. The current owner is asking $2 million. First, you need to gather information about the property's income and expenses. Let's say the property generates $200,000 in annual gross rental income. Next, you need to estimate the property's operating expenses. These include property taxes, insurance, maintenance, management fees, and utilities. Let's assume that the total operating expenses are $80,000 per year. Now you can calculate the net operating income (NOI) by subtracting the operating expenses from the gross rental income: $200,000 - $80,000 = $120,000. To determine the property's value using the income approach, you need to apply a capitalization rate (cap rate). The cap rate represents the expected rate of return on the investment. Let's assume that the market cap rate for similar apartment buildings in the area is 6%. To calculate the property's value, divide the NOI by the cap rate: $120,000 /

0.06 = $2,000,000. In this case, the property's value based on the income approach is $2 million, which is the same as the asking price. This suggests that the property is fairly priced, but you should still conduct further due diligence to confirm your analysis. You can also use the gross rent multiplier (GRM) to get a quick estimate of the property's value. The GRM is calculated by dividing the property's price by its annual gross rental income: $2,000,000 / $200,000 =

10. This means that the property is selling for 10 times its annual gross rental income. Compare this GRM to those of similar properties in the area to see if it's in line with market values.

What If...?

Let's explore some "what if" scenarios to illustrate how different factors can impact the valuation of a real estate investment using the income approach. What if the vacancy rate increases? Suppose the vacancy rate in our example apartment building jumps from 5% to 10%. This would reduce the gross rental income and consequently lower the NOI. A lower NOI would then result in a lower property value. What if operating expenses increase? Imagine that property taxes increase by $10,000 per year. This would increase the operating expenses and decrease the NOI, leading to a lower property value. What if the market cap rate changes? Suppose the market cap rate for similar apartment buildings rises from 6% to 7%. This would indicate a higher perceived risk in the market and result in a lower property value. What if you can increase rental income? If you can increase the rental rates by $50 per unit per month, this would increase the gross rental income and consequently boost the NOI. A higher NOI would then result in a higher property value. What if you can reduce operating expenses? If you can reduce the property's insurance costs by $5,000 per year by shopping around for better rates, this would decrease the operating expenses and increase the NOI, leading to a higher property value. By considering these "what if" scenarios, you can gain a better understanding of the potential risks and opportunities associated with a real estate investment. This can help you make more informed decisions and negotiate more effectively.

Checklist

Here is a quick checklist to help you remember the key steps involved in using the income approach to analyze real estate investments: 1. Gather income and expense data: Collect detailed information about the property's gross rental income, operating expenses, and vacancy rates.

2. Verify financial information: Scrutinize the seller's financial data for any inconsistencies or anomalies.

3. Calculate net operating income (NOI): Subtract the operating expenses from the gross rental income to determine the NOI.

4. Determine capitalization rate (cap rate): Research the market cap rates for similar properties in the area.

5. Calculate property value: Divide the NOI by the cap rate to estimate the property's value.

6. Use gross rent multiplier (GRM): Calculate the GRM and compare it to those of similar properties.

7. Conduct due diligence: Inspect the property thoroughly and verify all information.

8. Consider "what if" scenarios: Analyze how changes in income, expenses, or cap rates could impact the property's value.

9. Negotiate effectively: Use your analysis to make a informed offer.

10. Consult with professionals: Seek advice from experienced investors, appraisers, and real estate agents.

11. Review the property tax. Research online and at the county records, the potential for increases in your taxes.

12. Research crime statistics in the area. Low crime leads to happy tenants, and happy tenants pay on time.

13. Calculate the cost to repair, if there are any repairs needed.

14. Visit during the day and the night to see what type of environment the property has.

15. Ask the owner about their experience managing the property.

Question and Answer

Q: What is the difference between NOI and cash flow?

A: NOI (Net Operating Income) represents the property's income after deducting operating expenses but before deducting debt service (mortgage payments) and income taxes. Cash flow, on the other hand, is the actual cash an investor receives after paying all expenses, including debt service and income taxes.

Q: What is a good cap rate?

A: There's no universal "good" cap rate. It depends on factors like location, property type, and market conditions. Generally, higher cap rates indicate higher risk and potentially higher returns, while lower cap rates indicate lower risk and potentially lower returns.

Q: What are some common operating expenses?

A: Common operating expenses include property taxes, insurance, maintenance, management fees, utilities, and advertising.

Q: Can I use the income approach for residential properties?

A: Yes, you can use the income approach for residential properties that are being used as rentals. However, it's most commonly used for commercial properties.

Conclusion of real estate investment income approach

The income approach is a powerful tool for evaluating real estate investments. By understanding and applying the key concepts, you can make more informed decisions and avoid costly mistakes. Remember to always conduct thorough due diligence, verify financial information, and consider the impact of various factors on the property's income and expenses. With practice and persistence, you can master the income approach and unlock the full potential of your real estate investments.

Post a Comment