real estate investment comparable sales

Ever felt like you're wandering in the dark when trying to figure out if that investment property is truly a goldmine or just fool's gold? It's a common feeling. Real estate investment can be incredibly rewarding, but only if you know what you're doing. And a big part of that "knowing" comes down to understanding the market.

Imagine spending weeks, even months, researching a potential investment, only to find out later that you significantly overpaid. Or worse, you pass on a fantastic deal because you didn't have the right data to assess its true value. This is the reality for many investors who don't leverage a crucial tool.

That tool is comparable sales, often called comps.This article explores how understanding and utilizing comparable sales can make you a more informed, confident, and successful real estate investor.

In essence, we're diving into the world of comparable sales (or "comps") in real estate investing. You'll learn what they are, why they're essential, how to find them, and how to use them effectively. We'll discuss common pitfalls, hidden secrets, and proven strategies for leveraging comps to make smarter investment decisions. Keywords: real estate investment, comparable sales, comps, property valuation, investment strategy.

The Power of Personal Experience with Comparable Sales

I remember the first time I tried to analyze a potential flip. I found a property that looked promising, but I was completely lost when it came to figuring out what it was actually worth. I read articles and watched videos, but it all felt abstract. Then, I stumbled upon the concept of comparable sales. The idea seemed simple enough: find similar properties that had recently sold in the same area, and use their sale prices as a benchmark. Easier said than done! My initial attempts were frustrating. I pulled data from online sources, but the numbers seemed all over the place. Some properties were clearly not comparable, while others were missing crucial information. Eventually, I realized the importance of accurate data and localized expertise. I started reaching out to local real estate agents and tapping into their knowledge of the market. They helped me identify truly comparable properties and understand the nuances of the neighborhood. What I learned was invaluable. Comparable sales aren't just about finding properties with similar square footage and bedroom counts. It's about understanding the subtle factors that influence value, such as location, condition, upgrades, and even the view. By carefully analyzing these factors, I was able to develop a much more accurate estimate of the property's value. This newfound knowledge gave me the confidence to make an offer, and ultimately, the flip was a success. Real estate investment comparable sales are a guiding tool for anyone trying to get into investment.

What Exactly Are Real Estate Investment Comparable Sales?

At its core, a comparable sale is a recently sold property that shares key characteristics with the property you're trying to evaluate. Think of it as finding "twins" or "near-twins" in the real estate world. The more similar the properties, the more reliable the comparable sale becomes. What characteristics are important? Location is paramount. You want properties in the same neighborhood, or at least within a very similar geographic area. Physical attributes matter too: square footage, number of bedrooms and bathrooms, lot size, and architectural style. Condition is also a key factor. A fully renovated property will command a higher price than one that needs significant repairs. Finally, the sale date is critical. Real estate markets fluctuate, so you want to focus on recent sales, ideally within the last three to six months. Finding good comps is like detective work. You'll need to sift through data, verify information, and make informed judgments. But the effort is well worth it. By using comparable sales, you can avoid overpaying for a property, identify hidden value, and make more confident investment decisions. It also helps when deciding if an investment is good for the investor.

The History and Myths Surrounding Comparable Sales

The concept of using comparable sales has been around for a long time, even before the advent of online databases and sophisticated analytics. Real estate professionals have always relied on local knowledge and past transactions to estimate property values. In the "old days," this meant poring over paper records at the county courthouse and relying on word-of-mouth information from other agents. While the tools have changed, the underlying principle remains the same: past performance is a good indicator of future value. Of course, there are myths and misconceptions surrounding comparable sales. One common myth is that you can simply plug numbers into an online calculator and get an accurate valuation. While these tools can be helpful, they shouldn't be relied upon as the sole source of information. Another myth is that you need a large number of comparable sales to get an accurate estimate. While more data is generally better, a few carefully selected comps can be more valuable than a large number of irrelevant ones. The key is to focus on quality over quantity. Understanding the history and debunking the myths surrounding comparable sales can help you approach property valuation with a more critical and informed perspective. This helps when investing into any property.

Unveiling the Hidden Secrets of Comparable Sales

Beyond the basic principles, there are some hidden secrets to using comparable sales effectively. One secret is to look beyond the obvious similarities. Don't just focus on square footage and bedroom count. Dig deeper and consider factors such as the quality of construction, the presence of desirable features (like a finished basement or a swimming pool), and the overall appeal of the property. Another secret is to adjust for differences between the subject property and the comparable sales. If a comparable sale has a larger lot, or a better view, you'll need to make an adjustment to reflect that difference in value. This requires some judgment and experience, but it can significantly improve the accuracy of your valuation. A third secret is to talk to the neighbors. They can provide valuable insights into the neighborhood, the property's history, and any potential issues that might not be apparent from online data. Finally, don't be afraid to challenge the data. If something doesn't seem right, investigate further. Verify the information with multiple sources and use your own judgment to determine whether a particular comparable sale is truly relevant. Hidden secrets when it comes to property value are important to know before entering a new investment.

Recommendations for Utilizing Real Estate Investment Comparable Sales

My top recommendation is to use a combination of online tools and local expertise. Online databases can provide a wealth of information, but they shouldn't be your only source. Supplement your research by talking to local real estate agents, appraisers, and investors. They can provide valuable insights into the market and help you identify truly comparable properties. Another recommendation is to be patient and thorough. Finding good comparable sales takes time and effort. Don't rush the process or settle for subpar data. The more time you invest in your research, the more confident you'll be in your valuation. I also recommend keeping a record of your comparable sales. Create a spreadsheet or database to track the properties you've analyzed, along with the relevant data and your adjustments. This will help you build a library of comps that you can use for future investments. Also, I recommend working with an assistant.

Understanding Key Metrics in Comparable Sales

Beyond just finding similar properties, understanding the key metrics used in comparable sales analysis is crucial. One of the most important metrics is price per square foot. This is calculated by dividing the sale price of a property by its square footage. Price per square foot allows you to easily compare the values of properties of different sizes. However, it's important to remember that price per square foot is just one metric, and it shouldn't be used in isolation. Other important metrics include gross rent multiplier (GRM) and capitalization rate (cap rate), which are commonly used to value income-producing properties. GRM is calculated by dividing the sale price of a property by its annual gross rental income. Cap rate is calculated by dividing the property's net operating income (NOI) by its value or price. These metrics provide insights into the potential return on investment for a property. By understanding these key metrics, you can gain a more comprehensive understanding of the value of a property and make more informed investment decisions. When calculating the cap rate, make sure that it will give a return that is acceptable. This is so you are getting your moneys worth.

Tips for Finding the Best Real Estate Investment Comparable Sales

Finding the best comparable sales requires a strategic approach. Start by defining your search area. Focus on the immediate neighborhood of the subject property, and gradually expand your search radius if necessary. Use online databases to identify potential comps. Look for properties that are similar in terms of location, size, age, condition, and features. Verify the information with multiple sources. Don't rely solely on the data provided by online databases. Contact the listing agents, review property records, and talk to neighbors to confirm the accuracy of the information. Adjust for differences between the subject property and the comparable sales. Make adjustments for factors such as lot size, condition, upgrades, and amenities. Be objective in your analysis. Avoid letting your emotions influence your judgment. Focus on the data and use your best judgment to determine the true value of the property. Continuously refine your skills and knowledge. Attend real estate seminars, read industry publications, and network with other investors to stay up-to-date on the latest trends and best practices. Tips and tricks can go a long way in any industry that has multiple fields.

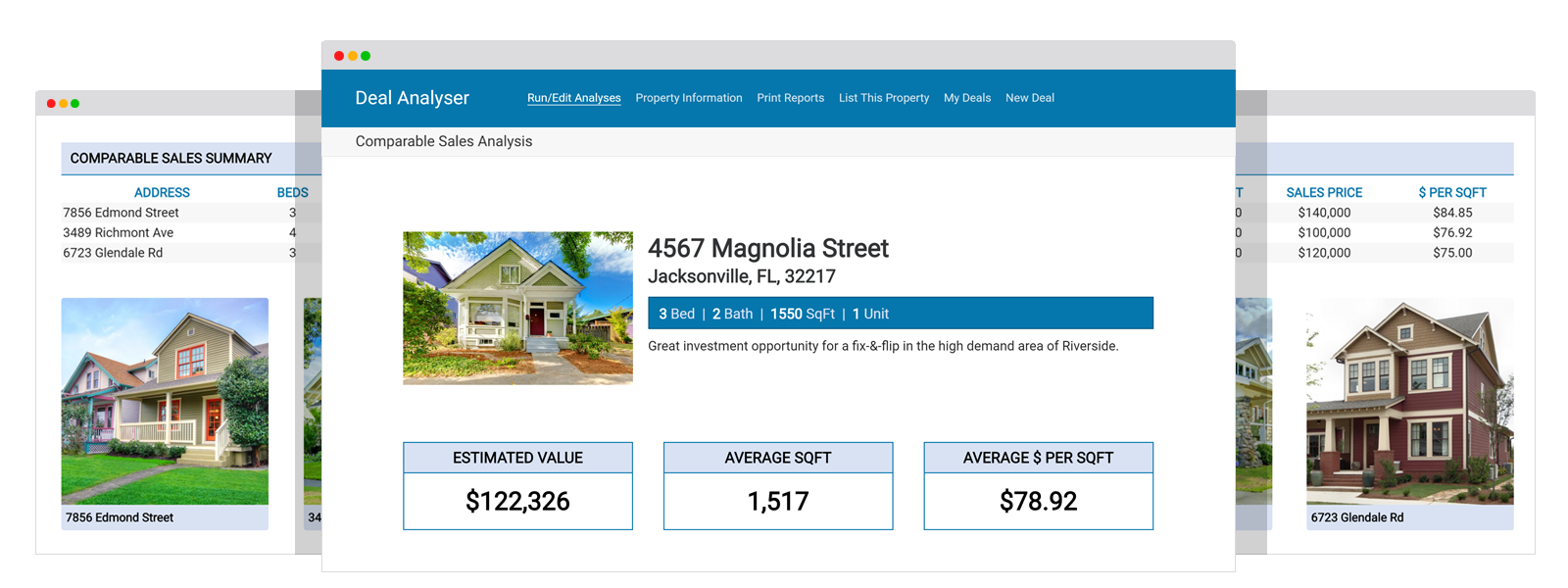

Using Technology to Streamline Your Comparable Sales Analysis

Technology has revolutionized the way we analyze comparable sales. There are now a variety of online tools and software platforms that can help you streamline the process. These tools can automate the data collection process, generate reports, and even create interactive maps that visualize the comparable sales in your area. One popular tool is the Multiple Listing Service (MLS), which provides access to detailed information about properties listed for sale. Other useful tools include Zillow, Redfin, and Realtor.com, which offer free access to property data and comparable sales information. In addition to these online tools, there are also a variety of software platforms designed specifically for real estate investors. These platforms can help you manage your portfolio, track your expenses, and analyze your investments. By leveraging technology, you can save time, improve accuracy, and make more informed investment decisions. Make sure that you are using credible online resources.

Fun Facts About Real Estate Investment Comparable Sales

Did you know that the most expensive house ever sold was in Hong Kong for over $360 million? That's a lot of comparable sales to research! Also, the comparable sales of the building and the area should also be taken into consideration. Here's another one: the oldest house in the United States is thought to be the Fairbanks House in Dedham, Massachusetts, built around 1641. Imagine trying to find comparable sales for that one! Real estate is a fascinating field with a rich history and countless interesting facts. From the most expensive properties to the oldest houses, there's always something new to learn. So next time you're analyzing comparable sales, take a moment to appreciate the unique and dynamic nature of the real estate market. Learning fun facts can add flavor into an industry or any kind of work field. It can also lead to interesting trivia questions to ask potential investors.

How to Find Real Estate Investment Comparable Sales

Finding comparable sales involves a multi-step process. Start with online resources. Websites like Zillow, Redfin, and Realtor.com provide valuable data, but remember to verify this information. The MLS (Multiple Listing Service) is a powerful tool, but access is typically limited to licensed real estate agents. Next, expand your search to include county records. These records can provide detailed information about past sales, including the sale price, date of sale, and property characteristics. Don't overlook the power of networking. Talk to local real estate agents, appraisers, and other investors. They can provide valuable insights into the market and help you identify potential comps. Drive around the neighborhood. Sometimes the best way to find comparable sales is to simply drive around the area and look for properties that are similar to the subject property. Finally, be persistent and patient. Finding good comparable sales takes time and effort. Don't give up easily and be prepared to dig deep to find the information you need. Research is key when it comes to finding the perfect comparable sales for your real estate investments.

What If Real Estate Investment Comparable Sales Are Scarce?

Sometimes, finding comparable sales can be challenging, especially in unique or niche markets. If you're struggling to find enough comps, don't panic. There are still things you can do. First, broaden your search area. Look for properties that are located slightly further away from the subject property, but are still within a similar market. Second, expand your search timeframe. Look for properties that sold a bit further back in time, but be sure to adjust for market changes. Third, consider using different types of properties as comps. If you can't find exact matches, look for properties that are similar in terms of size, age, and condition, even if they have different features or amenities. Finally, consider consulting with an appraiser. Appraisers are experts in property valuation and can provide valuable insights into the market, even in challenging situations. If comparable sales are scarce, there may also be a reason why. This could be due to economic downturn or it could also be due to the property being newly listed.

Listicle of Real Estate Investment Comparable Sales

Here's a quick list of things to remember:

- Location, location, location: The closer the comp is to the subject property, the better.

- Size matters: Look for properties with similar square footage and lot size.

- Age and condition: Focus on properties that are similar in age and condition.

- Recent sales: Use comps that have sold within the last three to six months.

- Verify your data: Don't rely solely on online sources.

- Adjust for differences: Make adjustments for factors such as lot size, condition, and amenities.

- Be objective: Avoid letting your emotions influence your judgment.

- Seek expert advice: Consult with real estate agents and appraisers.

- Stay informed: Keep up with the latest market trends and best practices.

- Be patient and persistent: Finding good comps takes time and effort.

Following this list will definitely help anyone find and learn more about real estate investment comparable sales.

Question and Answer About Real Estate Investment Comparable Sales

Q: What is the most important factor to consider when finding comparable sales?

A: Location is the most important factor. The closer the comp is to the subject property, the more reliable it will be.

Q: How many comparable sales do I need to get an accurate valuation?

A: There's no magic number, but generally, three to five good comps are sufficient.

Q: What should I do if I can't find enough comparable sales?

A: Broaden your search area, expand your search timeframe, or consider using different types of properties as comps.

Q: Should I rely solely on online resources for finding comparable sales?

A: No, you should verify the information with multiple sources and consult with real estate agents and appraisers.

Conclusion of Real Estate Investment Comparable Sales

Mastering the art of comparable sales analysis is essential for any serious real estate investor. By understanding the principles, utilizing the right tools, and seeking expert advice, you can make more informed decisions, avoid overpaying for properties, and increase your chances of success. So, dive in, do your research, and start leveraging the power of comparable sales to unlock the hidden potential of the real estate market.

Post a Comment