real estate investment break even analysis

Ever wondered how long it'll really take for your real estate investment to start paying off? It's more than just collecting rent; it's about understanding the numbers, the costs, and the timeline to profitability. Let's demystify the process and explore the crucial concept of break-even analysis in real estate investment.

Jumping into real estate can feel like navigating a maze of expenses. From mortgage payments and property taxes to maintenance costs and potential vacancies, it's easy to get lost in the financial details. Many investors struggle to accurately predict when their investment will truly start generating a profit, leading to unexpected financial strain or missed opportunities.

The central aim of a real estate investment break-even analysis is to determine the point at which your rental income covers all associated expenses. It's about finding that magic number – that occupancy rate, rental price, or timeframe – where you're no longer in the red and finally start seeing a positive return on your investment.

This article will unpack the complexities of real estate investment break-even analysis. We'll explore what it is, how to calculate it, delve into its history and some common myths, uncover some hidden secrets, provide recommendations, share some tips, and even some fun facts about this crucial financial assessment. We'll also answer some frequently asked questions and provide a listicle for quick reference.

What is the Goal of Real Estate Investment Break-Even Analysis?

The goal of real estate investment break-even analysis is straightforward: to pinpoint the exact moment when your investment transitions from a cost to a profit. My first venture into rental properties was a humbling experience. I bought a charming little house thinking it would be a cash cow. I estimated costs, projected rents, and felt confident. But I forgot to factor in vacancy periods accurately. For three months, the house sat empty between tenants, eating into my profits. That’s when I realized the true importance of break-even analysis. It's not just about covering the mortgage; it's about factoring in everything – property taxes, insurance, maintenance, management fees, potential repairs, and even those unexpected vacancy periods. The target is to determine the occupancy rate needed to cover all these costs, so you know how many months of the year you need to have the property rented to avoid losing money. Break-even analysis also helps you evaluate the impact of different rental rates or expense reductions on your profitability. You can use this information to make informed decisions about pricing, budgeting, and managing your property more efficiently. It is a powerful tool for setting realistic expectations and making smarter investment choices.

Understanding Real Estate Investment Break-Even Analysis

Real estate investment break-even analysis is a calculation that determines the point at which your rental income equals your total expenses associated with the property. In essence, it's finding the balance between the money coming in and the money going out. This isn't just about the mortgage payment; it encompasses all costs: property taxes, insurance, maintenance, repairs, property management fees, and vacancy costs. A complete analysis helps you understand how many months of rent you need to collect to offset all expenses. It’s a fundamental tool for assessing the viability of a real estate investment. A higher break-even point signifies a greater risk, as you need a longer period of consistent rental income to become profitable. Conversely, a lower break-even point indicates a more stable investment with a quicker path to profitability. Break-even analysis also allows you to compare different investment opportunities and identify those that offer the most favorable financial returns. By understanding your break-even point, you can make more informed decisions about pricing, budgeting, and managing your property to maximize your potential for success.

The History and Myths of Real Estate Investment Break-Even Analysis

While the formal concept of break-even analysis likely emerged alongside modern accounting practices, the core idea of understanding profitability dates back centuries. Landlords and property owners have always needed to understand their costs versus income, even without sophisticated calculations. However, the formal application of break-even analysis in real estate investment is a relatively recent development, coinciding with the rise of complex financial models and data analysis tools. There are a few common myths surrounding break-even analysis in real estate. One is that it's a one-time calculation. In reality, it should be a dynamic process, updated regularly to reflect changes in expenses or market conditions. Another myth is that it's overly complex. While it involves some calculations, the underlying concept is straightforward and accessible to anyone. Some also believe that break-even analysis is only relevant for large-scale investments. In reality, it's just as important for smaller properties, as it helps investors understand the true costs and potential returns. By dispelling these myths and understanding the historical context of break-even analysis, investors can use it effectively to make informed decisions and achieve their financial goals.

The Hidden Secrets of Real Estate Investment Break-Even Analysis

One of the biggest hidden secrets of break-even analysis is its ability to reveal the true cost of vacancy. It's easy to focus on the rent you're collecting when the property is occupied, but it's crucial to understand the financial impact of empty units. Vacancy costs go beyond just lost rental income; they also include ongoing expenses like utilities, maintenance, and marketing to find new tenants. Another often overlooked aspect is the impact of capital expenditures, such as replacing a roof or upgrading appliances. These expenses can significantly impact your break-even point, so it's important to factor them in when calculating your overall costs. Furthermore, break-even analysis can reveal the optimal rental price to maximize your profits. It helps you understand the trade-off between higher rent and potential vacancies. By carefully analyzing your expenses and rental market, you can find the sweet spot that allows you to achieve a profitable occupancy rate. The last secret that lies hidden behind the break-even analysis is its use for the sake of negotiations. You can use your break-even point as leverage during negotiations with suppliers, contractors, or even tenants. The better you understand your numbers, the more likely you are to strike a favorable deal.

Recommendations for Real Estate Investment Break-Even Analysis

When conducting a break-even analysis for your real estate investment, it is wise to be as thorough and detailed as possible. Start by meticulously documenting all your expenses, including mortgage payments, property taxes, insurance, maintenance costs, repair expenses, property management fees, and vacancy costs. Do not underestimate the importance of accurate expense tracking. Use a spreadsheet or accounting software to keep track of your income and expenses, and review your data regularly. You will need to make sure you also conduct thorough research on the local rental market to determine the prevailing rental rates and occupancy rates in your area. Then, consider your tolerance for risk. A higher break-even point indicates a higher level of risk, as you need a longer period of consistent rental income to become profitable. You may want to stick to lower-risk properties. Also, be sure to revisit your break-even analysis regularly. Market conditions can change quickly, so it's important to update your analysis to reflect any changes in income or expenses. Finally, seek professional advice. Consider consulting with a real estate accountant or financial advisor to help you with your break-even analysis. They can provide valuable insights and guidance, and ensure that you're making informed decisions about your investment.

Essential Factors to Include in Your Break-Even Analysis

To ensure your break-even analysis is accurate and useful, it's crucial to include all relevant factors. This extends beyond the obvious costs like mortgage payments and property taxes. You need to consider recurring expenses such as insurance premiums, property management fees (if applicable), and regular maintenance like landscaping and cleaning. Don't forget to factor in potential repair costs, even if they're not predictable. Setting aside a percentage of your rental income for repairs can help you avoid surprises down the road. Vacancy costs are another important factor to consider. Estimate the amount of time your property may be vacant each year, and factor in the lost rental income and any expenses associated with finding new tenants. In addition, consider capital expenditures, such as replacing a roof or upgrading appliances. These expenses can significantly impact your break-even point, so it's important to factor them in when calculating your overall costs. Remember, the more comprehensive your analysis, the more accurate and useful it will be.

Tips for Optimizing Your Real Estate Investment Break-Even Analysis

The process of break-even analysis should not be a one-time event. Regularly review and update your analysis to reflect changes in your income, expenses, or market conditions. When possible, implement strategies to reduce your expenses. This could involve negotiating lower rates with suppliers, finding ways to reduce energy consumption, or performing some maintenance tasks yourself. You may want to also explore opportunities to increase your rental income. This could involve increasing your rental rates, adding amenities to your property, or marketing your property more effectively. You can also focus on reducing vacancy periods. Promptly address tenant requests, respond to maintenance issues quickly, and make it as easy as possible for tenants to renew their leases. You should also consider offering incentives for long-term leases or referrals. You should use this analysis as a tool to make informed decisions about your investment. Are you thinking about renovating your property? Use break-even analysis to evaluate the potential impact on your rental income and expenses. You might want to get creative with your income stream and look at other ways to generate revenue from your property. These could include charging for parking, offering laundry facilities, or providing storage space. Consider consulting with a real estate professional to help you with your break-even analysis. They can provide valuable insights and guidance, and ensure that you're making informed decisions about your investment.

The Importance of Accurate Data

The foundation of a reliable break-even analysis rests on accurate data. Using estimates or outdated information can lead to misleading results and poor decision-making. Take the time to gather precise figures for all your income and expenses. This includes reviewing your mortgage statements, property tax bills, insurance policies, and maintenance records. Track your expenses meticulously, using a spreadsheet or accounting software to organize your data. Be sure to categorize your expenses appropriately, so you can easily identify areas where you can potentially reduce costs. When estimating future income and expenses, use realistic assumptions based on market research and historical data. Avoid being overly optimistic or pessimistic. It's better to err on the side of caution and underestimate your income and overestimate your expenses. This will provide a more conservative and reliable break-even analysis. Periodically review your data and update your analysis to reflect any changes in your income, expenses, or market conditions. This will help you stay on track and make informed decisions about your investment.

Fun Facts About Real Estate Investment Break-Even Analysis

Did you know that break-even analysis isn't just for real estate? It's a fundamental tool used across various industries, from manufacturing to retail, to determine the point at which a business becomes profitable. Speaking of other things, break-even analysis can help you identify the "hidden" costs of owning a rental property. Things like replacing appliances, painting the interior, and advertising the property can all add up and impact your break-even point. Interestingly, the break-even point is not static; it fluctuates based on factors such as changes in rental rates, expense levels, and occupancy rates. Keeping a close eye on these variables is key to staying on top of your investment. As a result, many investors use break-even analysis not just to assess the profitability of their current investments but also to evaluate potential new deals. Running the numbers helps them decide whether a property is worth pursuing. A well-calculated break-even analysis can give you a competitive edge. By understanding your costs and potential returns, you can negotiate better deals with suppliers, attract high-quality tenants, and ultimately maximize your profits. So, break-even analysis is like having a financial compass for your real estate journey, guiding you towards the destination of profitability.

How to Perform a Real Estate Investment Break-Even Analysis

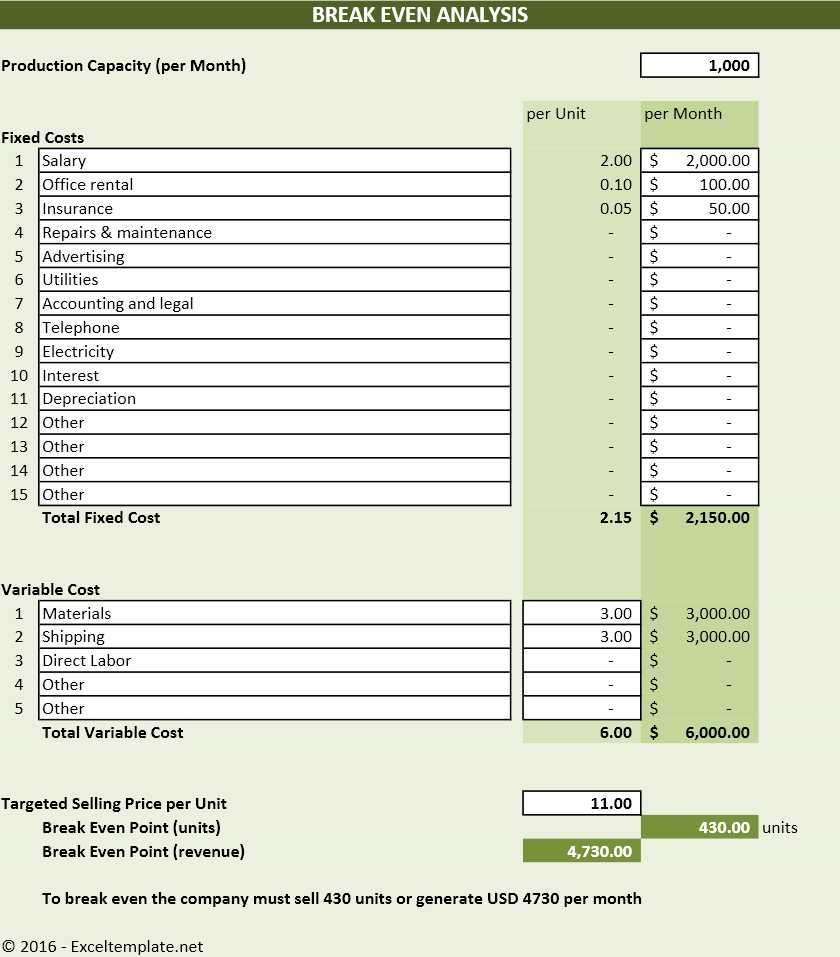

Performing a break-even analysis may seem daunting, but it can be broken down into manageable steps. First, gather all your relevant data, including your income and expenses. You can use a spreadsheet or accounting software to organize your data. Next, calculate your total fixed costs, which are expenses that remain the same regardless of your occupancy rate. These could include your mortgage payment, property taxes, insurance premiums, and property management fees. Then, calculate your total variable costs, which are expenses that vary depending on your occupancy rate. These could include utilities, maintenance costs, and repair expenses. Next, you can use a simple formula to calculate your break-even point. The formula is: Break-Even Point = Total Fixed Costs / (Rental Income per Unit - Variable Costs per Unit). This will give you the number of units you need to rent to cover all your expenses. Alternatively, you can calculate your break-even occupancy rate by dividing your total fixed costs by your potential rental income and multiplying by 100. You should use the result to make informed decisions about your investment. It could be that you need to adjust your rental rates, reduce your expenses, or focus on improving your occupancy rate to achieve profitability.

What If Scenarios in Real Estate Investment Break-Even Analysis

Break-even analysis is not just a static calculation; it's a dynamic tool that can be used to explore "what if" scenarios. By changing the inputs to your break-even analysis, you can assess the potential impact of various factors on your profitability. What if you increased your rental rates by 5%? How would that affect your break-even point? What if you reduced your expenses by 10%? How quickly would you become profitable? What if your property was vacant for two months? How would that impact your cash flow? You can also use break-even analysis to evaluate the potential impact of capital expenditures, such as replacing a roof or upgrading appliances. By factoring in these expenses, you can determine whether the investment is worthwhile. You can also use break-even analysis to compare different investment opportunities. By comparing the break-even points of different properties, you can identify those that offer the most favorable financial returns. You can also use break-even analysis to set realistic goals for your investment. By understanding your break-even point, you can determine the rental rates, occupancy rates, and expense levels you need to achieve to become profitable. This way, you're not just throwing money at properties hoping for a return; you're strategically planning for financial success.

Listicle of Real Estate Investment Break-Even Analysis

Here's a quick listicle of key takeaways about real estate investment break-even analysis: 1. It determines the point where rental income equals expenses.

2. It includes all costs: mortgage, taxes, insurance, maintenance, vacancy.

3. A lower break-even point signifies a more stable investment.

4. Regularly update your analysis to reflect market changes.

5. Accurately track expenses to improve accuracy.

6. Factor in vacancy costs and capital expenditures.

7. Use it to compare different investment opportunities.

8. Negotiate better deals with suppliers and contractors.

9. Set realistic rental rates based on the analysis.

10. Consult a professional for guidance and insights.

Question and Answer about Real Estate Investment Break-Even Analysis

Q: What happens if my expenses increase after I've done my initial break-even analysis?

A: You need to update your break-even analysis to reflect the new expenses. An increase in expenses will raise your break-even point, meaning you'll need to generate more income to cover your costs. Review your budget, identify areas where you can potentially reduce expenses, and adjust your rental rates if necessary.

Q: Is break-even analysis only useful for determining rental rates?

A: No, it's a valuable tool for making informed decisions about various aspects of your investment. It can help you assess the impact of capital expenditures, compare different investment opportunities, negotiate better deals with suppliers, and set realistic goals for your investment.

Q: How can I reduce my break-even point?

A: There are several ways to reduce your break-even point. You can lower your expenses by negotiating better rates with suppliers, reducing energy consumption, or performing some maintenance tasks yourself. You can also increase your rental income by raising your rental rates, adding amenities to your property, or marketing your property more effectively. Additionally, you can focus on reducing vacancy periods to ensure a consistent income stream.

Q: What's the biggest mistake people make when doing a break-even analysis?

A: The biggest mistake is failing to include all relevant expenses or using inaccurate data. Overlooking expenses like property management fees, vacancy costs, or capital expenditures can lead to a misleading analysis. Use realistic data to create a realistic budget.

Conclusion of Real Estate Investment Break-Even Analysis

Real estate investment break-even analysis is an indispensable tool for any aspiring or experienced property investor. By understanding how to calculate and interpret your break-even point, you gain valuable insights into the financial viability of your investments. This knowledge empowers you to make informed decisions, set realistic goals, and ultimately maximize your chances of success in the competitive world of real estate. So, embrace the power of numbers, crunch the data, and let break-even analysis guide you on your path to financial freedom!

Post a Comment